When it comes to forex, small and medium businesses are often described as ‘the squeezed middle.’ Why? Well, the truth is that most of the traditional FX providers have extensive offers for large scale clients, but very few bespoke offers for SMEs. As a result, such companies struggle to accept payments from abroad. Fortunately, there are new solutions cropping up on the market, which mean that this situation is likely to change.

Exploring current foreign exchange provision for SMEs

The latest edition of our Banking of the Future Think Tank was focussed on this very subject. We brought together financial sector experts from a range of FinTechs and large scale banks to discuss the forex challenges that SME owners are facing. We summarize our discussion and the proposed solution below.

We began by taking a look at the reasons why traditional banks tend not to adequately support SMEs and we noted that this comes down to three key points.

1.Extensive regulatory red tape

The long list of regulations prevents companies from accessing services such as underwriting or invoice financing. In practice, this means that SME owners face hurdles when they try to raise working capital and keep operations running.

2. Insufficient Forex risk advice

Findings from a HSBC survey show that 70% of CFOs said that their company had reduced earnings over the past couple of years due to unhedged Forex risk. This shows that many SME execs haven’t been offered sufficient risk advice and don’t have enough know-how in this area. In practice this means that SMEs that receive the bulk of their revenue from abroad might be faced with the challenge of remaining profitable.

3. An unaffordable one-size-fits-all approach to forex

The pandemic has certainly sped up the pace of digitalization in finance, but there haven’t been any simultaneous developments when it comes to FX provision. In effect, there’s still no global payments provision for SME clients.

How do the majority of SMEs currently manage their foreign payments?

- SMEs have no choice but to use the same solutions as large corporates and as a result have to pay high international transaction fees - and there’s often little transparency around these.

- Payment forms remain complex and difficult to fill out for the average SME owner or entrepreneur. They tend to use extensive financial jargon and different forms might be required for different currencies.

- Once the payment is made, it's often hard to assess when it will reach the final recipient and things, and such payments can be slow-moving, which can be frustrating in a fast-paced business environment.

Emerging foreign exchange services for SMEs

But the foreign exchange landscape is changing for SMEs due to the emergence of a range of new foreign exchange brokers which are offering to educate SME executives on FX risks and can help to prepare them for how to budget FX costs into their quarterly and yearly cash flow forecasts. They might also set a ‘costed level’ on the currencies they are using to ensure there are no surprises.

Companies offering such services include global risk management and payments platform AFEX, and XCAP which offers SMEs considerable savings on transferring and receiving currency from abroad.

New BaaS platforms offering foreign currency services to SMEs

There has also been a new wave of Banking as a Service (BaaS) solutions for FX, which forms part of the embedded finance revolution and may be particularly suited to SMEs.

In 10Clouds’ Business Banking of the Future workshops, we brainstormed just a few of the existing FinTech products which we were inspired by, with the aim of ultimately producing a prototype solution that would meet the needs of SME clients. Here are just a few of them:

OpenPayd - Through OpenPayd’s API-driven technology, companies can embed financial services into their products. The platform also enables FX conversion across a wide range of currencies, with real-time trading and API-enabled spot pricing. SMEs can benefit from OpenPayd’s international regulatory coverage through its network of global licences.

Curve - An innovative payment provider. It’s a mobile app where you can put all your cards from banks all over the world, and you can easily move your money between the cards. The app is also connected to ApplePay or Google. We particularly liked the interoperability of the payments.

Stripe and Airwallex - We thought that web-based payments infrastructure providers are the way forward when it comes to banking platforms for SMEs. But we also felt that customers, while they use these services, often want advice from a real person when they have a specific question or problem. That’s why there’s a future in connecting such services with establishments that have a brick and mortar physical store.

Kantox - A company that provides you with the system that presents all your currency exposure, supporting you in your international payment decision making process and hedging your position. We are living in the reality of services connected to payments, but there are few solutions which help you manage exposure. Should you hedge the position? Should you close it? What is the risk that you’ve exposed yourself to? The system tries to support you in the decision-making process.

TreasurUp - This platform integrates web, mobile, ERP connection and people. TreasurUp is designed to interface through its API architecture with just about every bookkeeping or ERP platform in the world.

What would an ideal-world FX platform for SMEs look like?

We then brainstormed the elements of an ideal-world SME platform, which would serve the needs of our SME leader persona, whom we identified as someone who was time-poor, often travelled for business purposes, wasn’t always convinced by new FinTech products and still tended to favor face to face interaction.

We determined that they would be looking for:

- Integrated services that offer them holistic payment solutions that cover all their needs.

- A solution that uses the latest AI technology to simplify banking processes for users.

- A platform with instant recognizability wherever you happen to be in the world.

- A tool that has inbuilt risk-management functionality.

- Human support where needed.

- A tool that has a real-time overview of the market and a currency fluctuation monitor.

Vivien Cheung, Director, Strategic Partnerships at Airwallex said, "Increasingly, businesses want to be able to manage technologies throughout the value chain under one roof. If you work with multiple partners, they should make it easy to turn particular features on and off, and add new services as the business expands internationally. I think the future lies in being able to connect services that have traditionally been siloed."

Agnieszka Durlej, Sales Director for Finance Markets at Bank Pekao SA said, “Our solution should take away the burden of running your business so that the SME owner can focus on what matters most - and why they started their business in the first place. That person should not be required to be an expert in everything. I also think that a ‘try for free’ approach would make sense. A trial period is crucial for building trust for an essentially unknown provider. Then the solutions could be bundled in a given plan or subscription.”

The Financial Companion App for SMEs

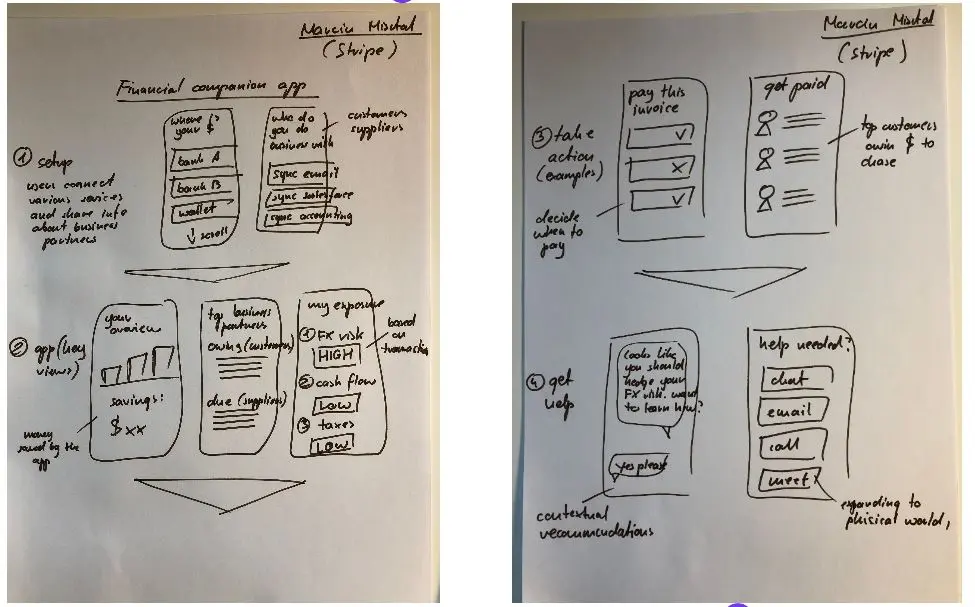

After brainstorming a number of different solutions during our Banking of the Future workshops, we came up with the following chosen platform.

This is an app ideal for SMEs which have lots of customers and suppliers in different countries. It enables you to connect with your bank accounts, your email, your CRM system, your accounting system and your invoicing system. It gives you a holistic overview of your balance, what receivables you’re expecting and when, and a resulting analysis on FX risk and cashflow. You as the client get a recommendation of things such as when is the optimal time to pay a certain invoice, make your FX payments and so on, as well as getting real-time information about currency fluctuations. You also get help through a chatbot and you have the option to meet a person if you wish, to discuss your risk strategy or talk through specific challenges.

FX risk management

In our discussion, we decided that one of the biggest questions is how to create an advisory tool for FX transactions, which would be a game-changer for customers. We would create a tool to define the risk profile and to propose the hedging scenarios for each customer, enabling them to manage their payments and investments more wisely. But we need to create some intelligent inbuilt patterns for this and distribute them throughout the application. The ultimate goal was to support each client with defining their risk management strategy.

Adhering to differing regulations

There is also the problem of differing regulations in different regions, as well as electronic money regulations. So the tool needs to take into account the regulatory requirements for all the countries that the customer operates in. When having hedging solutions in mind, the big question is how to deal with MIFID regulations? This is especially relevant when thinking about scalable solutions for different markets, as the local market interpretations are different.

Note that the solution was then developed into a fully working prototype and thoroughly user tested.

The Future of Foreign Exchange Solutions for SMEs

So what are the lessons learned? It’s obvious that the future of foreign exchange solutions for SMEs lies in integrated finance solutions, which are efficient, affordable and highly tailored to the end user. The goal of FinTech providers should be the creation of easy-to-use embedded platforms which connect with all the users’ existing banking providers, accounting systems, invoicing tools, CRMs and more. Such integration is very likely to improve the cash flow predictability. Ideally, the platforms should also feature an inbuilt risk tool and real-life support where needed, potentially through a partnership with brick and mortar businesses. The potential in this field is huge. It’s just about harnessing it in the right way.